Nvidia’s meteoric rise to a multi-trillion-dollar market capitalization has left many investors wondering whether the company has simply grown too large to deliver meaningful returns from here. This concern is not new. Market history is filled with examples of giants that either stagnated after hitting scale or continued compounding by reinventing themselves in the midst of transformative technological shifts. The core issue is not size in itself, but whether Nvidia remains positioned at the center of a long-lasting, global super-cycle of demand.

History provides useful analogies. Apple was once dismissed as “too big” when it crossed $200 billion in market value in 2010, yet its relentless expansion into iPhones, services, and wearables pushed it past $3 trillion a decade later. Microsoft languished in the 2000s after antitrust battles, but the cloud revolution re-energized it, propelling the company above $3 trillion. Amazon was viewed skeptically as an e-commerce play until AWS and advertising unlocked new growth, multiplying its valuation. In contrast, Cisco and Intel show the other path: both dominated their respective markets in the late 1990s, but when internet infrastructure demand matured and semiconductor leadership faltered, their growth stalled. Size did not stop them—stagnant markets and competitive shifts did.

Nvidia sits in a pivotal position. Its GPUs and networking technologies form the backbone of AI training and inference. Beyond chips, its CUDA software ecosystem, AI factory strategy, and expansion into orchestration and services create layers of lock-in. If AI adoption continues to accelerate—through hyperscaler build-outs, sovereign AI factories, enterprise copilots, and consumer applications—Nvidia’s current scale could simply be the midpoint of a long journey. But if competition erodes margins, AI demand normalizes, or regulation clips its wings, then growth could plateau.

Scenario Framework

To assess Nvidia’s future, we can frame several probability-weighted scenarios:

AI Super-Cycle (≈50%): Nvidia remains the dominant supplier of AI compute, benefiting from sustained infrastructure investment worldwide. Growth compounds at high single-digit rates, pushing market cap to $3.5–6 trillion.

Platform Expansion (≈30%): Nvidia evolves beyond hardware, monetizing recurring AI services and software, building a platform as sticky as Apple’s or Microsoft’s. Market cap climbs toward $5–7 trillion.

Saturation/Competition (≈15%): Rivals and custom chips erode its dominance, growth slows to a crawl, and Nvidia becomes another Cisco or Intel. Market cap stagnates around $2–3 trillion.

Disruption/Policy Shock (≈5%): Geopolitical tensions, export controls, antitrust, or disruptive new computing architectures undermine its position, cutting value to below $2 trillion.

Extended Bull Case (≈5%): AI proves to be as foundational as electricity or the internet, spreading across every industry and geography for decades. Nvidia retains dominance and layers on recurring revenues, enabling a valuation of $8–10 trillion.

| Scenario | Description | Probability | Market Cap Outlook (10Y) |

|---|---|---|---|

| AI Super-Cycle | GPU dominance, global AI factory buildout | 50% | $3.5T–$6T |

| Platform Expansion | Nvidia builds Apple-like recurring ecosystem | 30% | $5T–$7T |

| Saturation/Competition | Growth slows, Cisco/Intel path | 15% | $2T–$3T |

| Disruption/Policy Shock | Regulation or new tech undermines | 5% | <$2T |

| Extended Bull Case | AI as foundational as electricity, Nvidia as platform monopoly | 5% | $8T–$10T |

Timeline of Trajectories

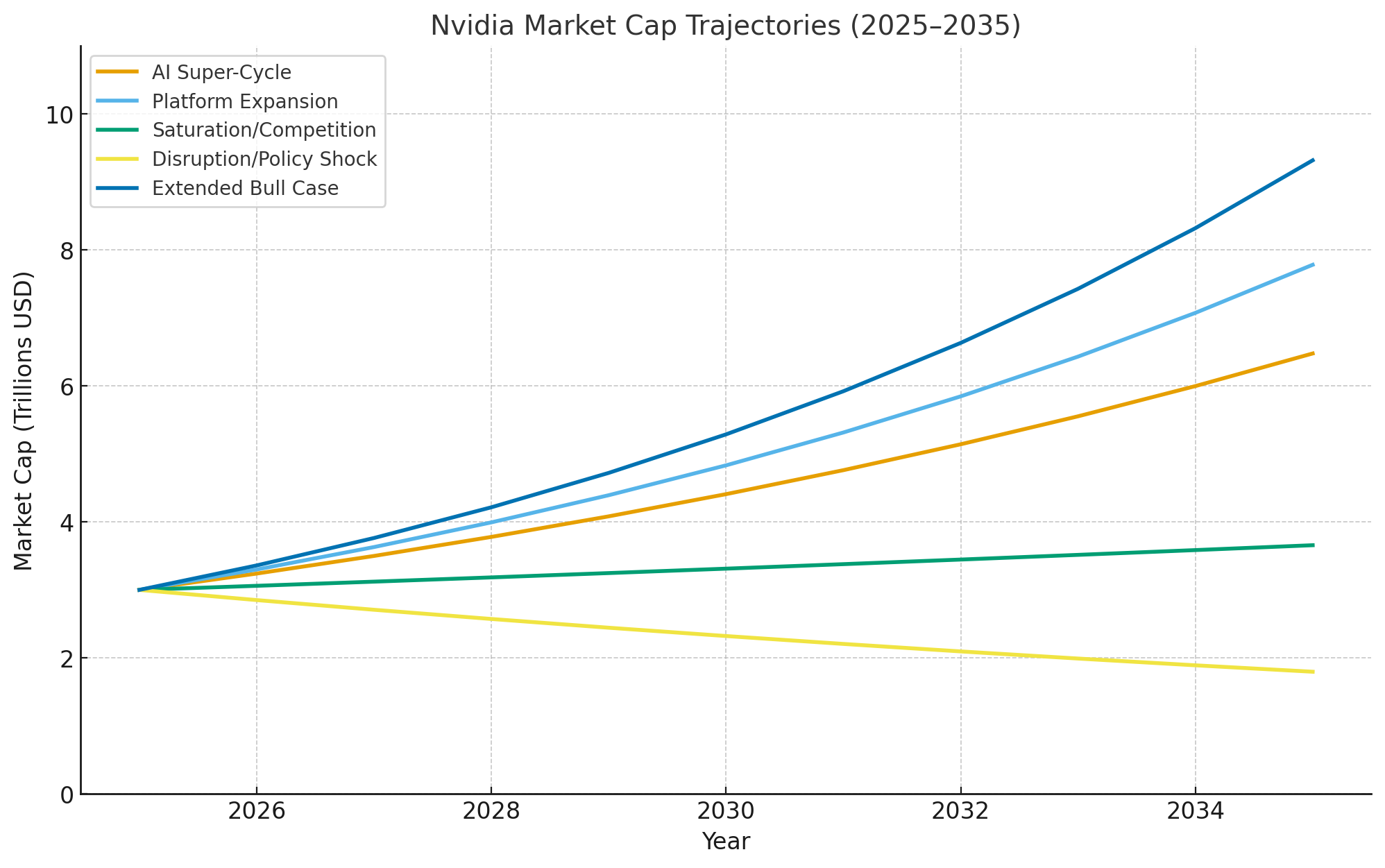

Looking at annualized projections from 2025 to 2035 makes the divergence between futures even clearer.

The AI Super-Cycle path grows steadily, reaching $6 trillion.

The Platform Expansion path grows faster, reaching $7 trillion.

The Extended Bull Case accelerates toward $9–10 trillion, a once-in-history outcome.

The Saturation path stagnates near $3 trillion, while the Disruption path declines toward $1–1.5 trillion.

Final Take

Nvidia’s sheer size is not in itself a barrier to growth. What matters is whether AI adoption proves to be the next great technological platform shift, akin to electricity, the internet, and mobile computing. If so, Nvidia has the chance to follow Apple and Microsoft into unprecedented territory, even brushing up against the $10 trillion mark in the most bullish scenario. If not, it may instead trace the arc of Intel or Cisco, still large and profitable but without compounding returns. For investors, the company represents both extraordinary upside and significant concentration of risk—the defining giant of the AI age, with futures ranging from stagnation to historic expansion.