The World FinTech Report (WFTR) 2019, published today by Capgemini and Efma, indicates that even though Open Banking has yet to reach maturity, the financial services industry is entering a new phase of innovation – referred to as “Open X” – that will require deeper collaboration and specialization. The report advocates that banks and other financial services ecosystem players must begin to plan accordingly and evolve their business models.

“The findings of the report could not be clearer: collaboration will be the foundation of the future of financial services”

The WFTR 2019 identifies a dual challenge: FinTechs are struggling to scale their operations and banks are stalling on FinTech collaboration. As a result, industry players are looking to leapfrog beyond Open Banking towards Open X, which is a more effective, structured form of collaboration, facilitated by Application Program Interface (API)1 standardization and shared insights from customer data. The era of Open X will create an integrated marketplace, with specialized roles for each player that will enable a seamless exchange of data and services, improving customer experience, and expediting product innovation.

Key findings of the report include:

Open X will transform industry norms and assumptions

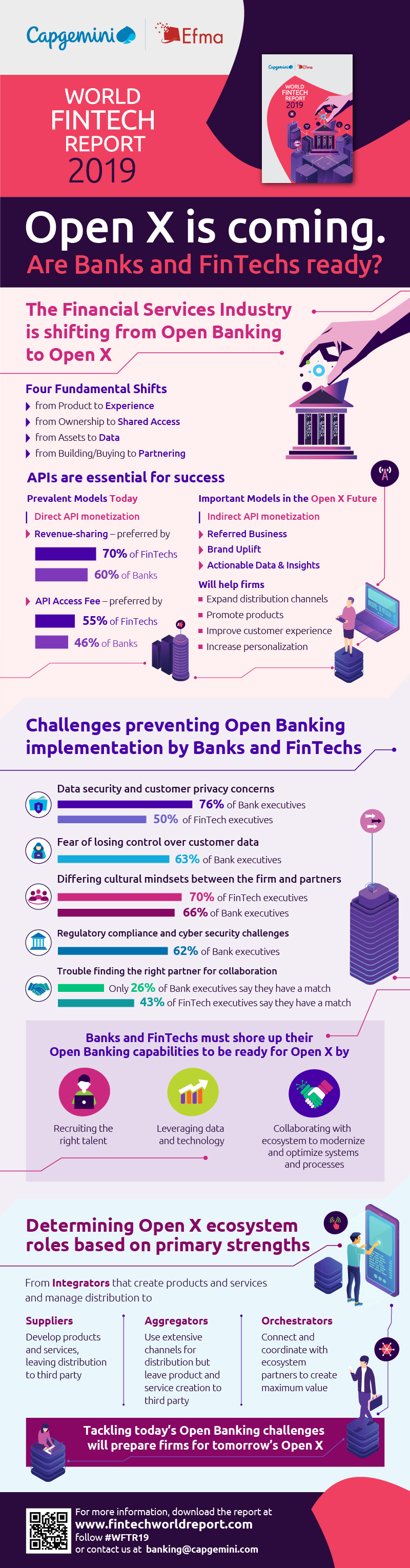

The advent of Open X is being driven by four fundamental shifts:

A move away from a focus on products to an emphasis on customer experience

The evolution of data as the critical asset

A shift from prioritizing ownership to facilitating shared access

Emphasis on partnering to innovate instead of buying or building new solutions

Open X will lead the financial services industry to a shared ecosystem or marketplace, in which the industry reintroduces the re-bundling of products and services, and both banks and FinTechs must re-evaluate their strategy for innovation and serving customers.

APIs will be critical Open X enablers

APIs, which allow third parties to access bank systems and data in a controlled environment, will be catalysts to creating the Open X marketplace. While customer data is already widely shared and leveraged in the industry, standardized APIs are not commonplace. Although requirements and regulations are complex, standardization will help to reduce fraud, improve interoperability, increase speed to market, and enhance scalability.

The WFTR 2019 also finds that industry players are looking at two potential monetization models for APIs – revenue-sharing (which 60% of banks and 70% of FinTechs think is feasible) and API access fees (supported by 46% of banks and 55% of FinTechs). However, only about a third of banking executives said they are currently well equipped to monetize APIs.

Privacy, security and collaboration concerns may slow progress

While banks and FinTechs said they understand the importance of collaboration, apprehension over privacy and security remain top of mind. When asked what concerns them about Open Banking, the vast majority of banks identified data security (76%), customer privacy (76%), and loss of control of customer data (63%). FinTechs were more optimistic about Open Banking, but 50% expressed fears over security and privacy, and 38% over the loss of control of customer data.

When asked about roadblocks to effective collaboration, 66% of banks and 70% of FinTechs pointed to a difference in the other’s organizational culture/mind-set, 52% of banks and 70% of FinTechs mentioned process barriers, and a lack of long-term vision and objectives were listed as gates by 54% of banks and 60% of FinTechs. Only 26% of bank executives and 43% of FinTech leaders said they had identified the right Open Banking collaboration partner. These responses suggest that many banks and FinTechs remain unprepared for Open Banking, let alone for the increased demands of data sharing and integration that Open X will bring.

Open X participants must choose strategic, specialty-based roles

Within the Open X marketplace, banks will need to enhance their integrated (traditional) model first and then focus on areas of specialized strength. The WFTR 2019 identifies three strategic roles expected to evolve as a part of Open X:

Suppliers will develop products and services;

Aggregators will amass products and services from the marketplace and distribute them through internal channels, holding onto customer relationships;

Orchestrators will act as market connectors and coordinators, facilitating partner interactions.

According to the report, integrated firms2 are likely to struggle to match the time to market of an ecosystem of specialists and find it challenging to meet the unique demands from customers. Within the Open X marketplace, many incumbents may not be best positioned to compete as an Orchestrator and their strengths may lead them to other roles. No matter what role they assume in Open X, however, they must recruit the right talent, leverage data and technology, and collaborate with FinTechs to first ensure better internal capabilities for competitive delivery of relevant services in the current Open Banking scenario.

“Open Banking has long been regarded as transformational for financial services, but this report shows it is just one part of a much bigger picture,” said Anirban Bose, CEO of Capgemini’s Financial Services and Member of the Group Executive Board. “The industry is on the verge of a more comprehensive evolution, where there is opportunity to leapfrog into an integrated marketplace that we are calling Open X. In Open X, there will be seamless sharing of data, and ecosystem partners will be able to collaborate in a far more comprehensive way. Our research suggests that banks and FinTechs need to prepare themselves for a more radical change than many previously anticipated.”

“The findings of the report could not be clearer: collaboration will be the foundation of the future of financial services,” said Vincent Bastid, Secretary General of Efma. “In the era of Open X, ecosystem players will have to work together more effectively than they have previously. Only by embracing collaboration and new, specialist roles can both banks and FinTechs thrive and best serve their customers. It’s clear that many barriers to collaboration still exist, and there is an urgent need to overcome them for collective benefit.”

Report methodology

The World FinTech Report 2019 is based on a global survey encompassing responses from 116 traditional financial services firms and 40 FinTech firms including banking and lending, payments and transfers, and investment management. Questions sought to yield perspectives from both FinTech and traditional financial services firms— exploring the emergence of Open Banking in the financial services industry. It sheds light on the impact the new ecosystem will have on all the stakeholders, the challenges and concerns that firms will face, and the emergence of new businesses and monetization models in this space.

About Capgemini

A global leader in consulting, technology services and digital transformation, Capgemini is at the forefront of innovation to address the entire breadth of clients’ opportunities in the evolving world of cloud, digital and platforms. Building on its strong 50-year heritage and deep industry-specific expertise, Capgemini enables organizations to realize their business ambitions through an array of services from strategy to operations. Capgemini is driven by the conviction that the business value of technology comes from and through people. It is a multicultural company of over 200,000 team members in more than 40 countries. The Group reported 2018 global revenues of EUR 13.2 billion.

Visit us at www.capgemini.com. People matter, results count

About Efma

A global non-profit organization, established in 1971 by banks and insurance companies, Efma facilitates networking between decision-makers. It provides quality insights to help banks and insurance companies make the right decisions to foster innovation and drive their transformation. Over 3,300 brands in 130 countries are Efma members.

Headquarters in Paris. Offices in London, Brussels, Andorra, Stockholm, Bratislava, Dubai, Milan, Montreal, Istanbul, Beijing, Tokyo and Singapore. Learn more www.efma.com.

____________________________________________

1 Application programming interface (API) refers to a set of functions and procedures that a player opens to the external world to allow the creation of applications that access the features or data of an operating system, application, or other service.

2 Integrated firms refer to the firms that perform all the functions on their own without collaborating or leveraging other firms in the ecosystem. Many of the banks in the current ecosystem are integrated firms as they build, produce, and distribute their own products for all business lines (without leveraging FinTechs or other players in the ecosystem)