The International Bunker Industry Association (IBIA) and S&P Global Platts, the leading independent provider of information and benchmark prices for the commodities and energy markets, have agreed on a collaboration agreement to help market participants across the shipping ecosystem prepare ahead of the implementation of the International Maritime Organization (IMO) low sulfur marine fuel regulations in January 2020.

Under the terms of the agreement, Platts and IBIA will offer shipping industry market participants:

Joint webinars series – to update and educate IBIA members and S&P Global Platts clients on practical market related developments ahead of IMO 2020 implementation, featuring speakers from both organizations.

Price assessments and data insight – Platts will provide IBIA with complementary access to its bunker data and insights including Bunkerwire and its full suite of 0.50% Marine Fuel Oil price assessments to help inform and add transparency to IBIA research.

Platts Market On Close demonstrations – complementary tours to help IBIA members around the world understand the Platts MOC, the process which ensures Platts price assessments reflect market value through a robust and transparent methodology based on tested market data.

Global conference collaboration – including the provision of Platts Pricing and Analytics speakers and IBIA experts at IMO related conferences

Platts IMO 2020 insight to be made available to IBIA members including white paper research, news and analysis

Unni Einemo, Director of IBIA and its representative at the IMO said: “We are very pleased to work with S&P Global Platts in bringing industry stakeholders the tools they need to manage the transition to IMO 2020. IBIA has been heavily engaged in working at the IMO to help develop guidelines for effective implementation, including preparations such as tank cleaning contained in the IMO’s Ship Implementation Plan, and recently in a Joint Industry Project to develop guidance on the safe supply and use of compliant fuels. Through this new collaboration, we will also have access to market data and analysis from a trusted partner.”

Vera Blei, Global Director, Head of Oil Markets, S&P Global Platts said: “We are delighted to strengthen our close partnership with IBIA which aligns with our ongoing commitment to support the global shipping community as it transitions towards IMO 2020. The transparency offered by our full suite of Marine Fuel 0.5% and HSFO price assessments together with the in-depth market insight provided by our global News and Analytics teams plays an important role in helping the industry understand and comply with what many consider to be the most disruptive change in living memory.”

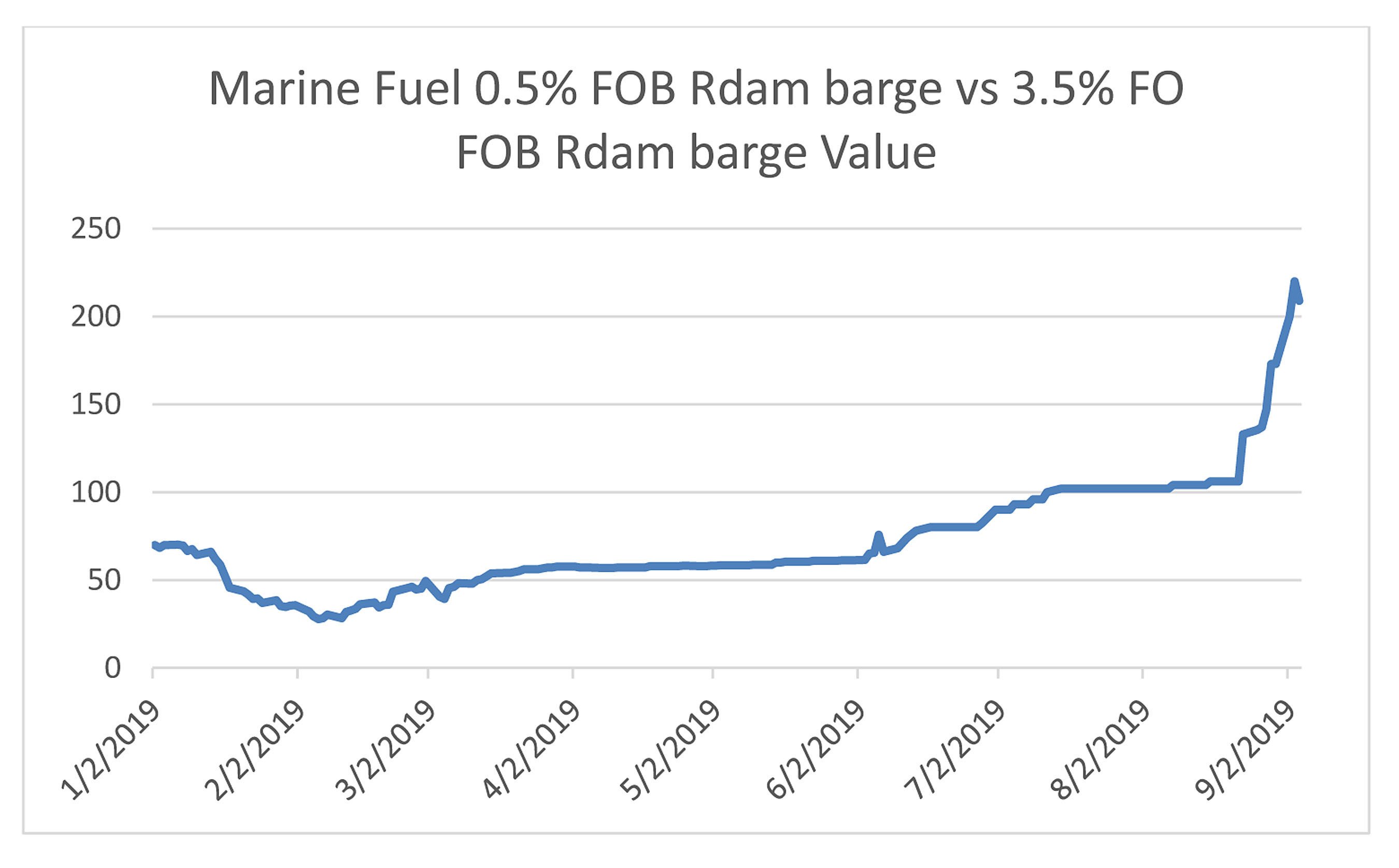

The premium of 0.5% marine fuel to high sulfur fuel oil in Europe has grown this year as preparations continue in earnest for the implementation of the new sulfur cap.

The FOB Rotterdam Marine Fuel 0.5% barges were assessed at a $69.75/mt premium January 2, the first day of Platts 0.5% Marine Fuel assessments but increased during August to a premium closer to $210/mt. Contributing to the increase in the 0.5% vs.3.5% spread was increased demand causing a firming of the Platts 0.5% Marine Fuel assessments ahead of the January 2020 implementation, while softening of the 3.5% high sulfur fuel oil driven by falling demand for bunker fuel, with market participants less inclined to utilize storage options.

In Asia, Singapore premiums for Marine Fuel 0.5% to the Mean of Platts Singapore 380 CST high sulfur fuel oil reached as high as $135.00/mt in June, with the premium on September 1 around $120/mt. According to traders the relatively large amount of 0.5% being stored in large tankers near Singapore, in addition to in land-based storage tanks, and the relatively low demand levels were the reason for the decline in the premium of 0.5% over 3.5% from June to September.

About IBIA

The International Bunker Industry Association (IBIA) is the voice of the global bunker industry and represents all stakeholders across the industry value chain. IBIA promotes improved knowledge and standards in the industry and lobbies for effective, pragmatic and workable regulations.

Our membership includes ship owners/operators, bunker suppliers, traders, brokers, barging companies, storage companies, fuel testing agencies, surveyors, port authorities, credit reporting companies, lawyers, P&I clubs, equipment manufacturers, journalists and marine consultants. IBIA represents the industry at the International Maritime Organization. For more information, visit https://ibia.net/

About S&P Global Platts

At S&P Global Platts, we provide the insights; you make better informed trading and business decisions with confidence. We’re the leading independent provider of information and benchmark prices for the commodities and energy markets. Customers in over 150 countries look to our expertise in news, pricing and analytics to deliver greater transparency and efficiency to markets. S&P Global Platts coverage includes oil and gas, power, petrochemicals, metals, agriculture and shipping.

S&P Global Platts is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies and governments to make decisions with confidence. For more information, visit www.platts.com.

SOURCE S&P Global Platts

Related Links

http://www.platts.com