The Federal Reserve is set to release the minutes from its July 29–30 FOMC meeting today at 2:00 p.m. Eastern time. These documents are always a major market event, offering investors a rare look behind the curtain at the central bank’s internal debates. Unlike the short, carefully worded policy statement, the minutes reveal the full range of opinions across the committee, … [Read more...] about Fed Minutes Land Today: Why Investors Are on Edge

Briefing

AI, Semiconductors, and the Stock Market: Bubble Risk or Productivity Breakthrough?

The stock market right now is living in two worlds. On one side, AI-driven sectors—anchored by semiconductors—are surging, pulling in massive flows of capital and investor enthusiasm. On the other, traditional brick-and-mortar sectors like housing remain weak, dragged down by high rates and consumer strain. The question for investors is whether this divergence signals the early … [Read more...] about AI, Semiconductors, and the Stock Market: Bubble Risk or Productivity Breakthrough?

AI Economy vs. Brick-and-Mortar Economy: Boom, Bubble, or Breakthrough?

The current divergence between the AI-driven economy and the traditional brick-and-mortar economy raises a question that is haunting investors: are we witnessing the dawn of a new industrial revolution or simply inflating another bubble reminiscent of the dotcom boom of 2000? The semiconductor sector, especially the analog chipmakers that serve industrial automation and … [Read more...] about AI Economy vs. Brick-and-Mortar Economy: Boom, Bubble, or Breakthrough?

The Market’s Harsh Verdict on Software: Be Truly AI-First or Be Left Behind

A shift is underway in investor psychology that is upending the software sector. The stock market is increasingly drawing a hard distinction between companies built natively around artificial intelligence and those attempting to retrofit AI into legacy workflows. For the latter group, no amount of branding, bolt-on features, or incremental upgrades is convincing Wall Street … [Read more...] about The Market’s Harsh Verdict on Software: Be Truly AI-First or Be Left Behind

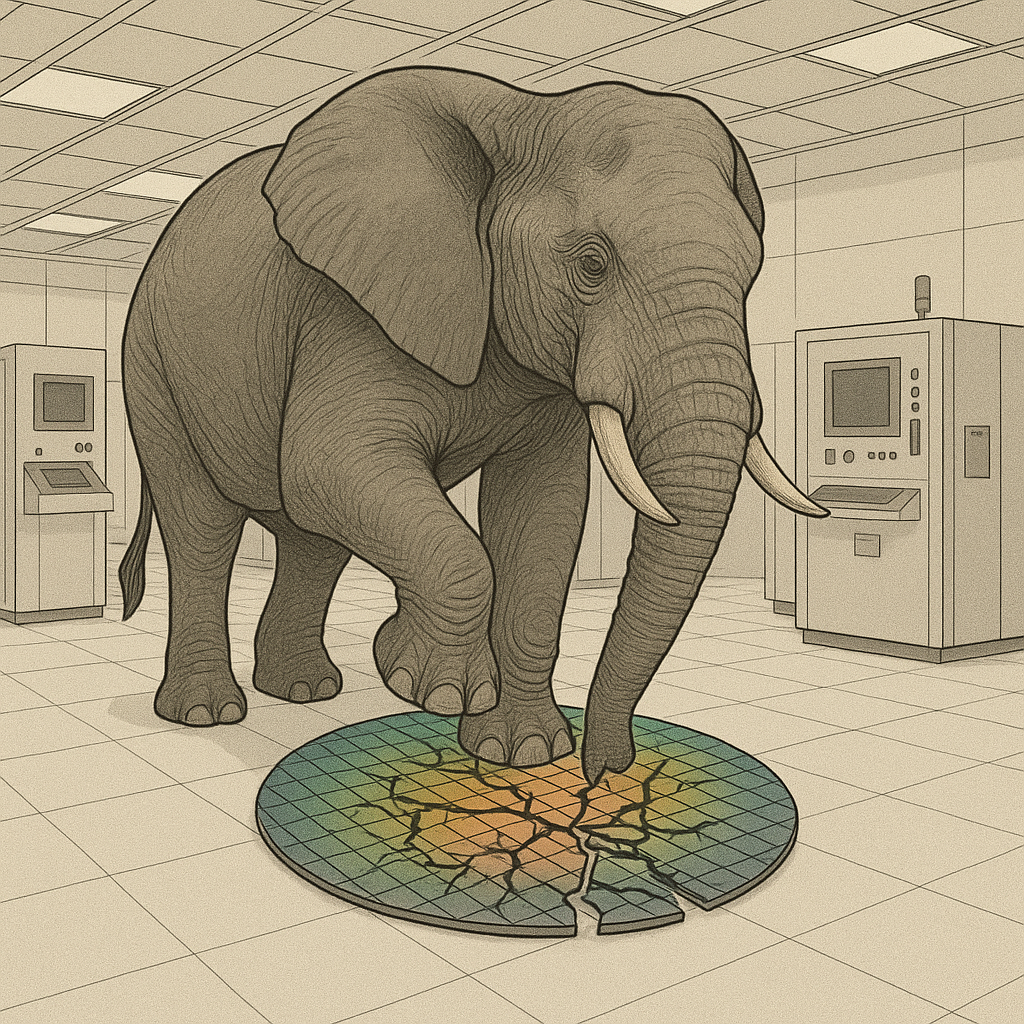

Trump, Leave the Semiconductor Industry Alone

Donald Trump’s growing obsession with using tariffs, penalties, and headline-grabbing deals to control the semiconductor industry is not industrial policy—it is economic sabotage wrapped in nationalist rhetoric. His interventions are less about securing America’s technological future and more about exerting transactional leverage, extracting concessions, and forcing companies … [Read more...] about Trump, Leave the Semiconductor Industry Alone