Over the past decade, the semiconductor industry has witnessed a dramatic shift, with AMD emerging as a formidable competitor to Intel, a long-time leader in the field. This transformation is vividly illustrated in the comparison of their market capitalizations from 2014 to 2024. The story of AMD’s rise is not just a tale of financial growth but also a narrative of strategic innovation, resilience, and the relentless pursuit of technological excellence.

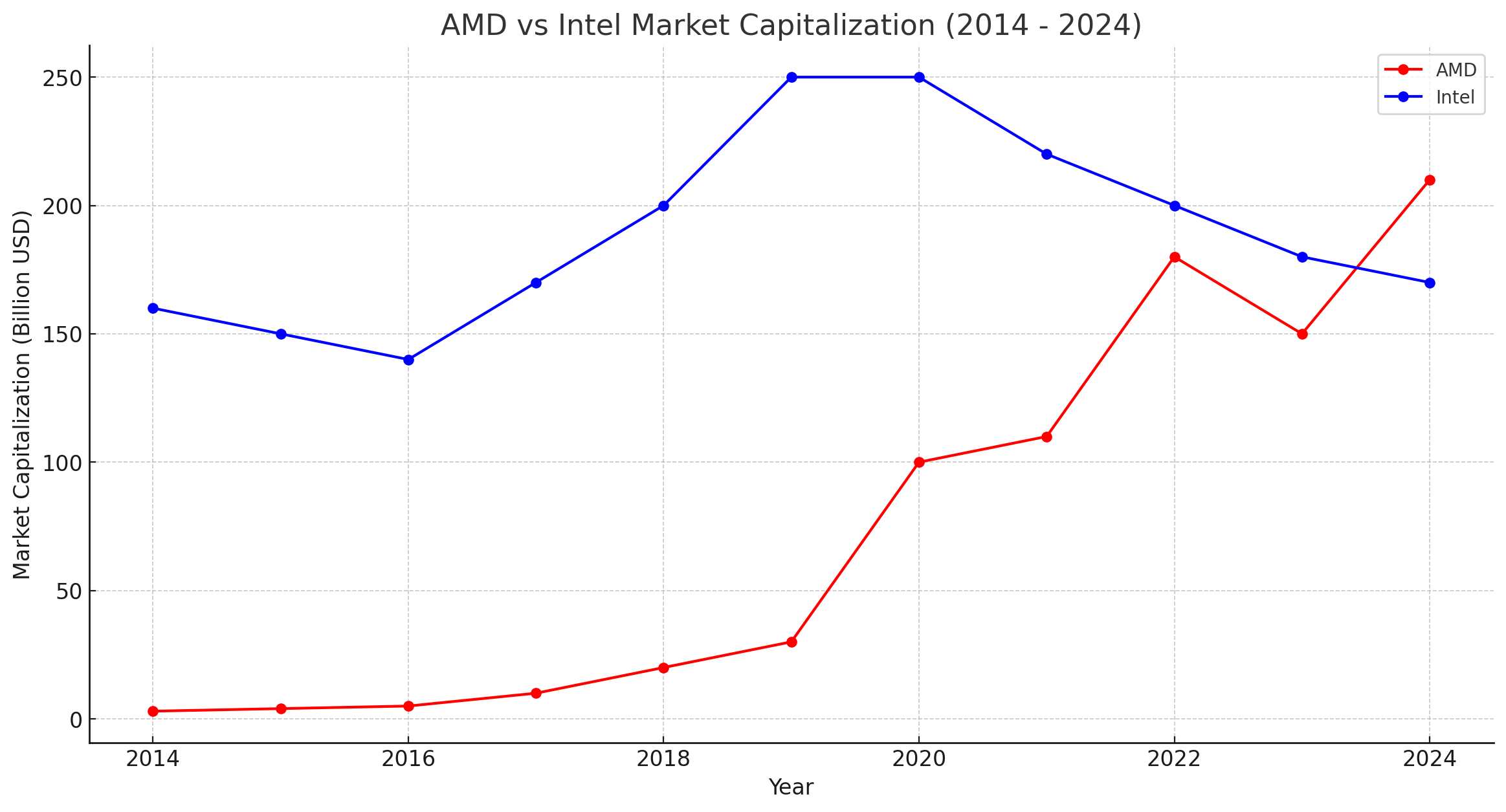

In 2014, Intel’s dominance was unchallenged, boasting a market cap of $160 billion compared to AMD’s modest $3 billion. Intel’s extensive history of leading the market in semiconductor technology, coupled with its massive production capabilities and a well-established customer base, placed it in a seemingly unassailable position. AMD, on the other hand, was navigating through turbulent waters, struggling to carve out its niche in a highly competitive industry.

The chart above reflects the market capitalizations of AMD and Intel from 2014 to 2024, with AMD represented in red and Intel in blue. This visualization clearly demonstrates the rapid growth of AMD’s market capitalization in recent years, surpassing Intel around 2022. Intel, while still significant, shows a more stable trend with some fluctuations, maintaining a high market cap but not matching AMD’s recent growth surge.

However, AMD’s fortunes began to change with the introduction of its Zen microarchitecture in 2017. This breakthrough design significantly improved the performance and efficiency of AMD’s processors, marking the beginning of a new era for the company. By 2017, AMD’s market cap had surged to $10 billion, reflecting growing investor confidence and market interest.

The subsequent years saw AMD capitalizing on this momentum. By 2020, AMD’s market cap had skyrocketed to $100 billion, driven by continuous innovation and strategic acquisitions, such as the landmark purchase of Xilinx. This acquisition not only expanded AMD’s product portfolio but also positioned it at the forefront of emerging technologies like artificial intelligence, 5G communications, and data center solutions.

Intel, while maintaining a strong market presence, faced challenges that began to erode its market dominance. Although its market cap remained relatively stable, peaking at $250 billion in 2020, Intel struggled with production delays and increased competition. The company’s efforts to diversify its offerings, including its foray into the discrete GPU market, were met with mixed success. As AMD continued to gain market share, Intel’s market cap experienced a gradual decline, settling at $170 billion by 2024.

The year 2022 marked a pivotal moment in the semiconductor industry. For the first time, AMD’s market cap surpassed Intel’s, reaching $180 billion. This milestone was a testament to AMD’s strategic vision and execution. It demonstrated the company’s ability to not only innovate but also to effectively compete against industry giants. By 2024, AMD’s market cap stood at $210 billion, reinforcing its position as a key player in the semiconductor sector.

AMD’s ascension is a compelling narrative of transformation. It highlights the impact of visionary leadership, strategic investments, and relentless innovation. AMD’s journey from a struggling competitor to a market leader underscores the dynamic nature of the semiconductor industry and the constant drive for technological advancement.

Looking ahead, the future of the semiconductor industry promises to be equally dynamic. With both AMD and Intel continuing to innovate and adapt to changing market demands, the competition between these two titans will undoubtedly shape the technological landscape for years to come. As AMD solidifies its position, it will be fascinating to observe how Intel responds to these challenges and what new strategies it will employ to reclaim its market leadership.